US economists study COVID-19 impact on energy

COVID-19-induced reductions in electricity pricing and energy demand from the shuttered US economy could be especially problematic for merchant baseload generators including nuclear, according to an assessment by the Brattle Group. Electricity loads across most of the USA fell during February and March, but less than half of this decline is likely attributable to COVID-19, the report finds.

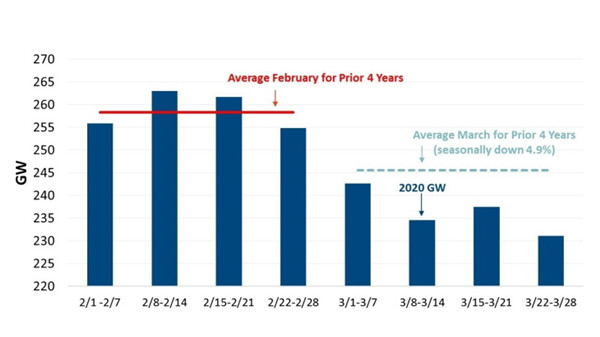

US electricity load in February and March 2020 relative to the previous four years (Image: Brattle Group)

Some significant utility impacts from the pandemic's effects can already be anticipated, said Frank Graves, a Brattle principal and a co-author of Impact of COVID-19 on the US Energy Industry.

"The utilities' cost of capital likely has increased due to increased volatility and cost-recovery risks. Further, some merchant generators, which are directly exposed to market prices and lower demand, are likely to face financial challenges. We expect the impact of COVID-19 to become more discernible in the coming weeks as information emerges about how long the business closures are likely to last," he said.

Up to the end of March, the visible effect of the pandemic on US utility industry market conditions has lagged relative to the depth of impact on other sectors, such as healthcare and employment, the report's authors note. This is partly due to the essential nature of the utility industry, they said.

Across six major US centralised wholesale markets operated by independent system operators (ISOs), monthly average electric load fell by 8.7% in March 2020 as compared to the average of the previous four years. Over half of this decline (4.9%) can be attributed to seasonal factors observed in prior years, the report finds, while the remainder (3.8%) "could" be attributable to COVID-19. "It may be that the full force of COVID-19 is not yet being felt," the report notes.

COVID-19-induced reductions in locational marginal prices (LMP) and energy demand will undermine revenues for most generation, and this could be especially problematic for merchant baseload such as coal, nuclear and some renewables, the report finds. The LMP forms the basis for payments to generators and payments by buyers in such markets. Daily LMPs have fallen since February across several ISOs, although this has in part been due to weather.

"As of the beginning of April, ISOs have not discussed in detail their COVID-19 impacts or concerns, but to the extent they have shown analysis, their estimates are similar to ours," the report notes.

The Brattle Group says it intends periodically to update its overview, which is meant to provide empirical context for understanding how the COVID-19 pandemic is and may continue to affect the energy industries.

Researched and written by World Nuclear News

- China Institute of Atomic Energy

- Nuclear Power Institute of China

- Southwestern Institute of Physics

- China Nuclear Power Operation Technology Corporation, Ltd.

- China Nuclear Power Engineering Co., Ltd.

- China Institute for Radiation Protection

- Beijing Research Institute of Uranium Geology (BRIUG)

- China Institute of Nuclear Industry Strategy (CINIS)

- China Nuclear Mining Science and Technology Corporation